ABA Bank Boosts Conversion Rate and Cuts Acquisition Costs by 65% with Regula Identity Verification Solution

Kristina – ks@regulaforensics.com

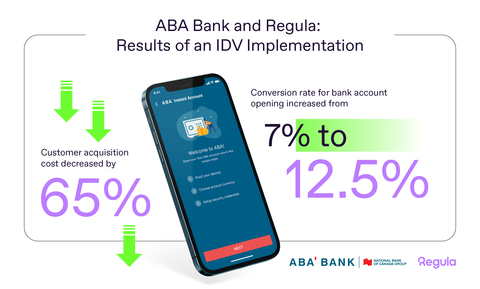

Regula, a global developer of forensic devices and identity verification solutions, helped ABA Bank, the largest Cambodian commercial bank, enhance its customer onboarding process via their mobile app. Upon implementing Regula Document Reader SDK, the bank has achieved a 65% reduction in customer acquisition costs and an increase in account opening conversion rate from 7% to 12.5%.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20241217060846/en/

Regula helped ABA Bank significantly enhance its customer onboarding process by integrating advanced identity verification into their mobile app. (Graphic: Regula)

ABA Bank is renowned for its commitment to innovative digital financial solutions. To facilitate remote bank account opening via smartphone, ABA Bank introduced the country’s first electronic Know Your Customer (eKYC) solution in late 2020 through the ABA Mobile app. This fully automated procedure allowed customers to access the bank's products and services by submitting their Cambodian National ID cards or passports for verification.

However, the initial process involved several challenges:

- The app's technologies did not allow the reading of MRZ data in Cambodian national IDs.

- The digital onboarding process required improvements to make it more customer centric.

- There was a significant dependence on manual checks to ensure high security and compliance.

These issues resulted in a high manual workload, prompting ABA Bank to seek a more reliable document verification solution.

After evaluating different solutions, ABA Bank selected Regula Document Reader SDK for its accuracy, speed, pricing, and ease of integration.

Implementing Regula's solution fully automated the onboarding process. To start the procedure, the user takes a picture of their national ID card or passport with a smartphone camera. If the picture is of poor quality, Regula's solution notifies the user to retake it. Once a proper ID image is obtained, Regula Document Reader SDK instantly recognizes the document type, identifies the data zones, and verifies the information in seconds, ensuring high accuracy and fraud detection.

The whole project of implementing Regula Document Reader SDK was completed within just one month. Throughout the process, ABA Bank received extensive support from the Regula team and leveraged the detailed developer documentation to ensure smooth and quick implementation of the solution.

The results were impressive:

- ABA Bank significantly improved the conversion rate for its digital onboarding via its mobile application. The conversion rate for bank account opening increased from 7% to 12.5%.

- The customer acquisition cost decreased by 65%.

- The team that was busy verifying the data of customers onboarded via the mobile app can now focus on other important tasks, leaving the job to Regula's solution.

"Implementing Regula Document Reader SDK has significantly enhanced our client onboarding processes. Our developers integrated the solution efficiently during a short period, thanks to the clear documentation and the supportive Regula team. The app's enhanced user experience and new interface during eKYC have been positively received. This has resulted in a smoother account opening process for our customers and increased our confidence in the data received during the eKYC process," says Zokhir Rasulov, Chief Digital Officer at ABA Bank.

"We see yet another testament to how a robust and reliable identity verification process can positively impact business outcomes. By partnering with ABA Bank and implementing Regula Document Reader SDK, we not only enhanced the accuracy and efficiency of their customer onboarding process, but also significantly reduced costs and improved conversion. We're proud to contribute to ABA Bank's success, and look forward to continuing our collaboration to drive further innovations in the Banking sector," says Ihar Kliashchou, Chief Technology Officer at Regula.

If you are interested in learning more about how ABA Bank enhanced its eKYC and remote onboarding procedure, read the full success story.

About ABA Bank

ABA Bank is the largest commercial bank in Cambodia by total assets, customer deposits, gross loans, and profitability based on the National Bank of Cambodia's Annual Supervision Report 2021, 2022, and 2023. As of June 30, 2024, the bank's total assets amounted to US$12.3 billion.

ABA Mobile, the #1 free financial mobile app in Cambodia, boasts 3.9 million users as of the end of Q3 2024. The bank has also achieved a 67% eKYC onboarding rate for new customers.

With 99 branches, 46 ABA 24/7 self-banking spots, more than 1,700 self-banking machines, and advanced online and mobile banking platforms, ABA Bank reaches out to more than 4 million customers with an array of modern financial services.

About Regula

Regula is a global developer of forensic devices and identity verification solutions. With our 30+ years of experience in forensic research and the most comprehensive library of document templates in the world, we create breakthrough technologies for document and biometric verification. Our hardware and software solutions allow over 1,000 organizations and 80 border control authorities globally to provide top-notch client service without compromising safety, security or speed. Regula has been repeatedly named a Representative Vendor in the Gartner® Market Guide for Identity Verification.

Learn more at www.regulaforensics.com.

View source version on businesswire.com: https://www.businesswire.com/news/home/20241217060846/en/

Business wire

Business wire

Add Comment